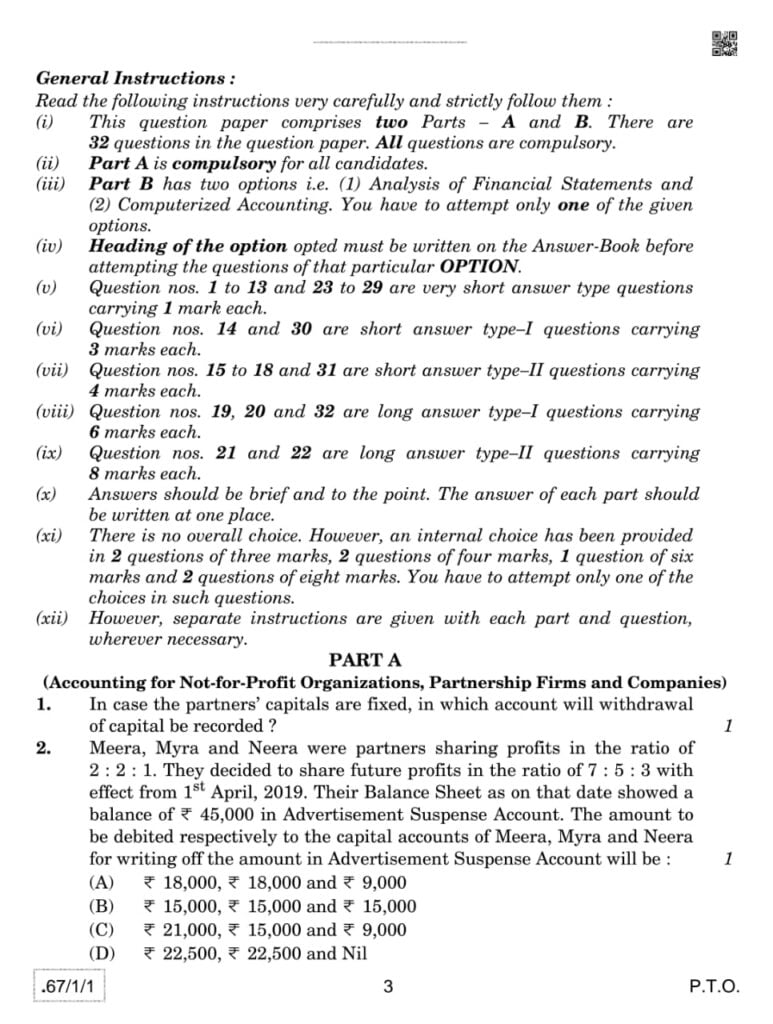

class 12 accountancy question paper 2025 with solutions:

Here you can prepare IIT / AIIMS / PMT online test for free No Register here and students can find CBSE Previous Year Question Papers Class 12 Accountancy from the last 8 years for all subjects.

CBSE sample paper 2024 class 12 accountancy with solutions, sample paper of accountancy class 12 2025 term 2, CBSE class 12 accountancy question paper with solutions, APC sample paper class 12 accountancy pdf, sample term 2, accounts marking scheme class 12 2025 term 2, sample 2023-2024 with solutions term 2 Class 12 Accountancy Question paper 2025 with solutions

लेखाशास्त्र पेपर

Answers………

Ans.1– Partners’ Capital Accounts

Ans.2- (A)/ 318,000, 518,000 and 9,000

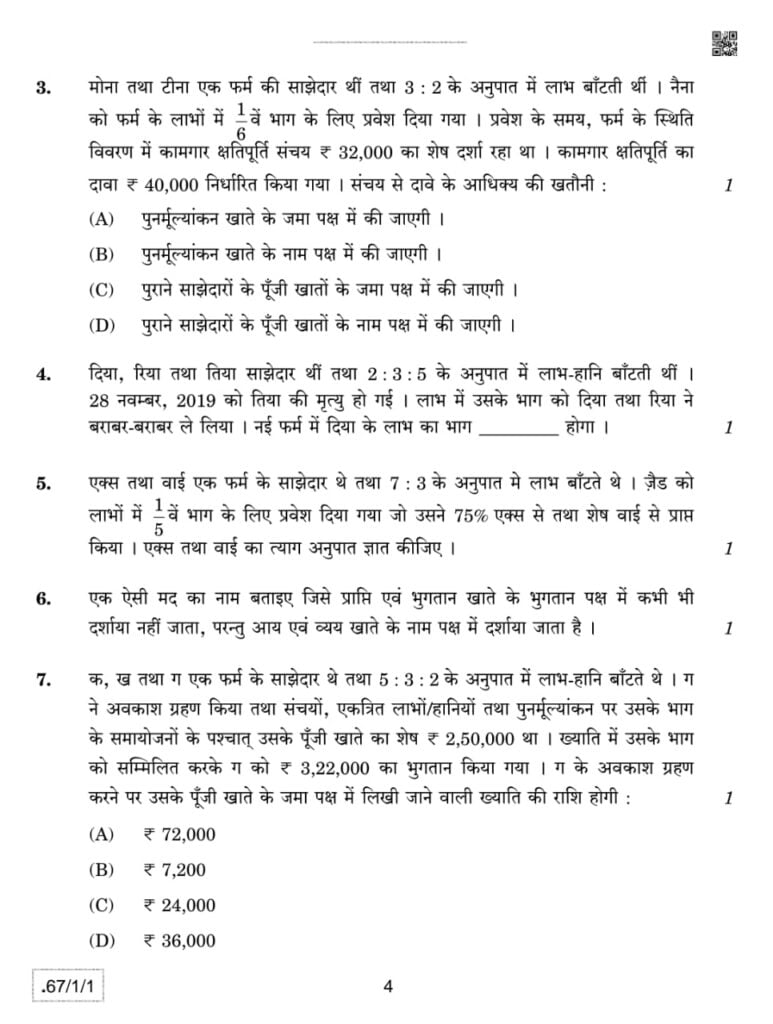

Ans.3- (B) / Debited to Revaluation Account

Ans.4- 9/20

Ans.5- 3:1

Ans.6- Any one of the following

Loss on sale of fixed assets

Depreciation

Outstanding expenses at the end

Prepaid expenses in the beginning of the year

Ans.7– (A)/72,000

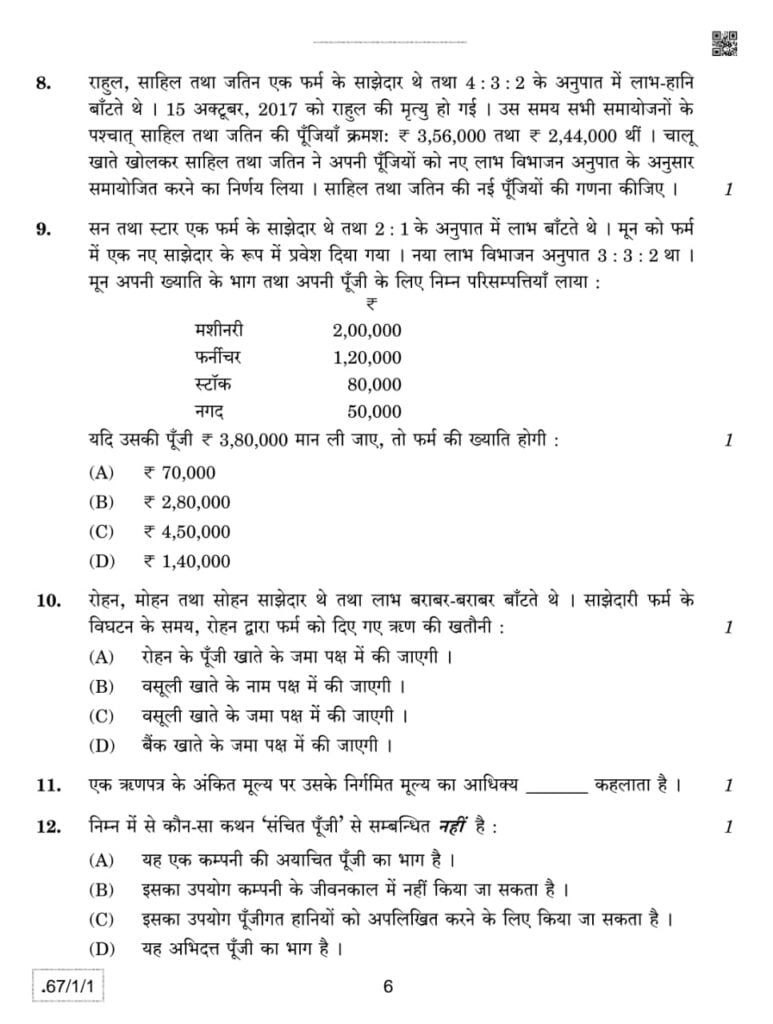

Ans.8– Sahil’s new Capital = 3,60,000

Jatin’s new Capital = 32,40,000

Ans.9- (B)/2,80,000

Ans.10- (D) / Credited to Bank Account

Ans.11– Premium

Ans.12- (C) / It can be used for writing off capital losses

Ans.13– Any one of the following

Provision for doubtful debts

Investment fluctuation fund

Accumulated depreciation

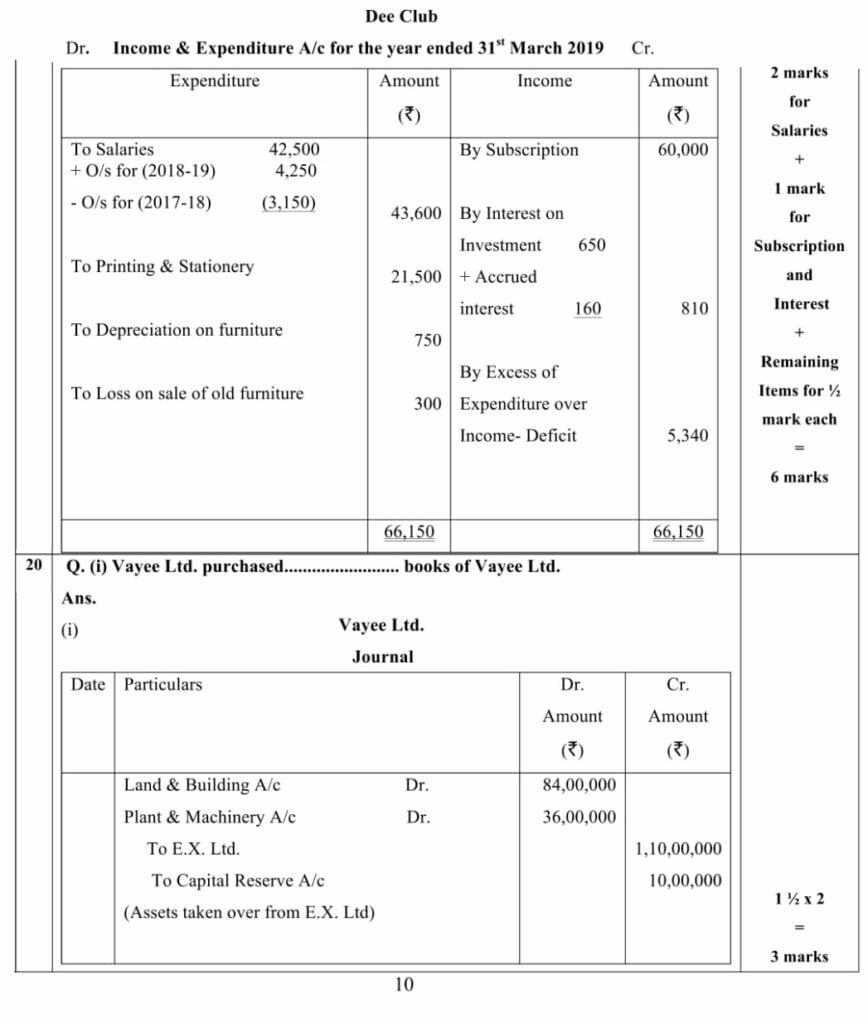

Ans.14 -Income & Expenditure A/c of a Sports Club for the year ended…..

| Expenditure | Amount ₹ | Income | Amount ₹ |

| To Match expenses | 64,000 |

Sports Club

Balance sheet (An extract)

as at….

| Liabilities | Amount ₹ | Assets | Amount ₹ |

| Prize fund + Interest on Prize 44,000 | Prize fund investment | 44,000 | |

Fund Investment 6,000 Less Prizes awarded (46,000) | 4000 |

OR

Answer – Stock of Medicines A/c

| Particulars | Amount ₹ | Particulars | Amount ₹ |

| To Balance b/d | 60000 | By Income and Expenditure A/c | 3,72,500 |

| To Cash A/C | 46500 | medicines consumed | |

| To Creditors A/C | 276000 | By Balance c/d | 10,000 |

| 3,82,500 | 3,82,500 |

Alternatively:

Calculation of Amount of Medicines Consumed = Opening Stock of Medicines +Purchases (Cash +Credit)+ Closing Stock of Medicines= 60,000+ (2,76,000+*46,500) – 10,000= 3,72,500

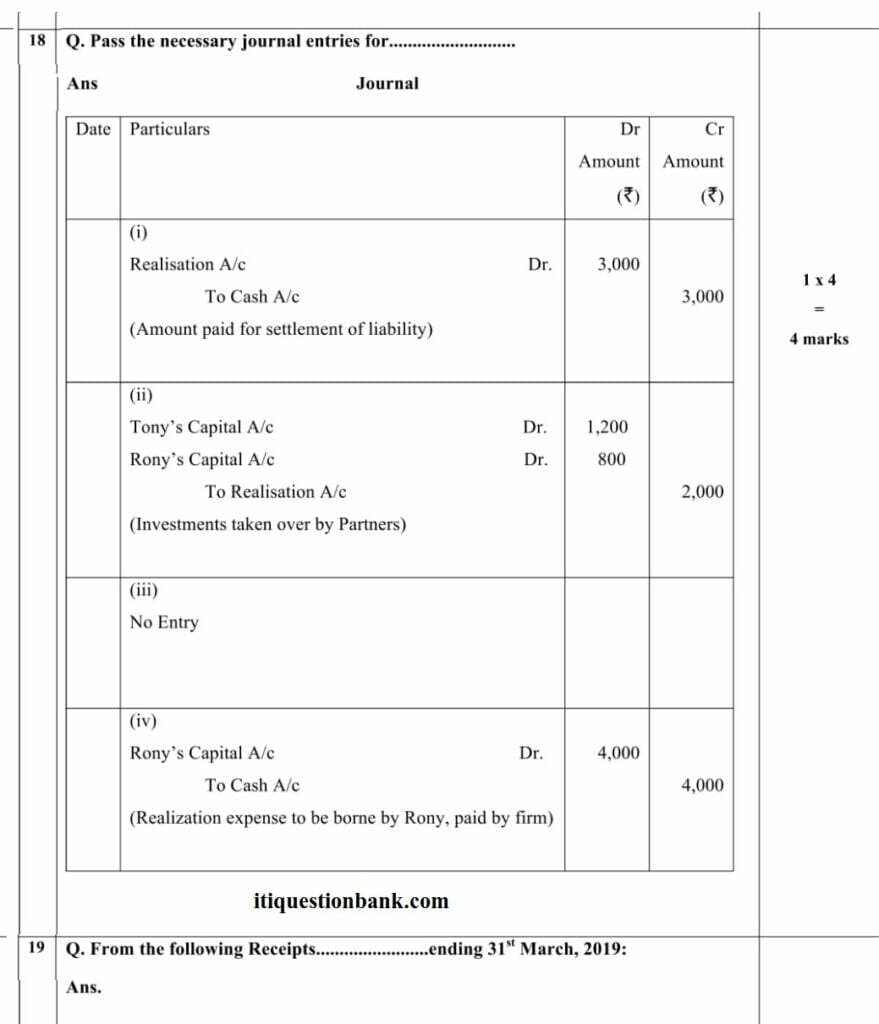

Ans.15-Journal

| Date | Particulars | Dr. Amount ₹ | Cr. Amount ₹ |

| Ram’s Capital Alc Dr. | 180 | ||

| Sohan’s Capital A/c Dr. | 630 | ||

| To Mohan’s Capital A/c (Adjustment entry for interest on drawings wrongly charged) | 810 |

Working note adjustment Table

| Particulars | Ram ₹ | Mohan ₹ | Sohan ₹ |

| Interest on drawings, wrongly debited | 1080 | 1440 | —- |

| Loss to be debited | 1260 | 630 | 630 |

| Net Effect | 180 Dr. | 810 Cr. | 630 Dr. |

full credit be given)

or

Answer.15- Profit & Loss appropriation A/c for the year ended 31 March, 2019

| Particulars | Amount ₹ | Particulars | Amount ₹ |

| To Interest on Capital | By Profit & Loss A/c -Net Profit b/d By Interest on Drawings | 2,53,000 | |

| Yadu’s current A/C 54,000 | Yadu’s current A/C 3,200 | ||

| Vidu’s current A/C 30,000 | Vidu’s current Alc 2,800 | ||

| Radhu’s current A/c 24,000 | 108000 | Radhu’s current A/c 2,000 | 8000 |

| To Profit transferred to | |||

| Yadu’s current A/C 61,200 | |||

| Vidu’s current A/C 45,900 | |||

| Radhu’s current A/c 45,900 | 153,000 | ||

| 2,61,000 | 2,61,000 |

Answer.16 – Journal

| Date | Particulars | Dr Amount | Cr Amount |

| Furkan’s capital A/c Dr | 24000 | ||

| Barkat’s capital A/c | 8000 | ||

| To Tanmay’s capital A/c (Tanmay’s share of goodwill adjusted) | 32000 | ||

| Profit & Loss suspense A/c Dr. | 8,667 | ||

| To Tanmay’s capital A/c (Share of Profit for the year credited to deceased Partner’s Capital A/C) | 8,667 | ||

| Tanmay’s capital Alc Dr. | 8,40,667 | ||

| To Tanmay’s Executor’s/ Tanmay’s Executor’s Loan A/C (Deceased Partner’s Capital Balance transferred to Executor’s A/c) | 8,40,667 | ||

| Tanmay’s Executor’s A/c Dr. | 95,000 | ||

| To Bank A/C (Payment made to Executor) | 95,000 | ||

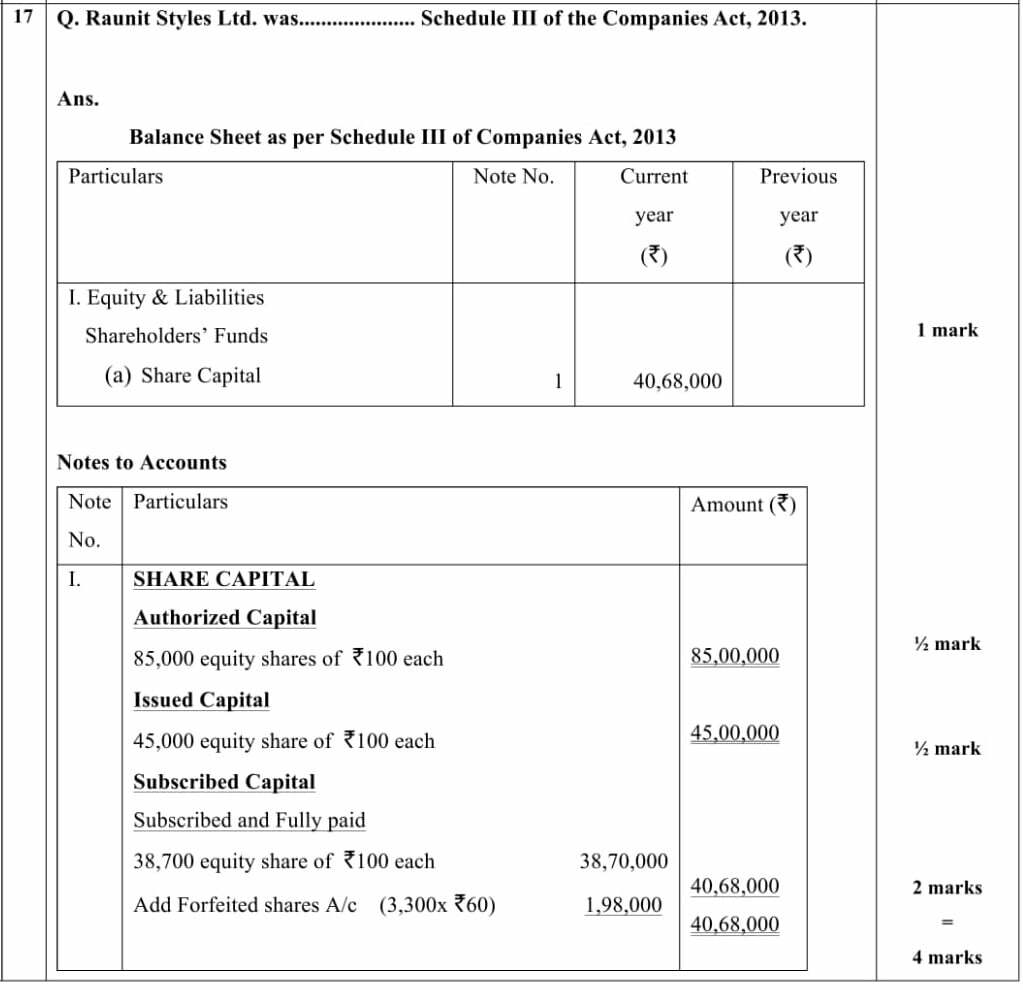

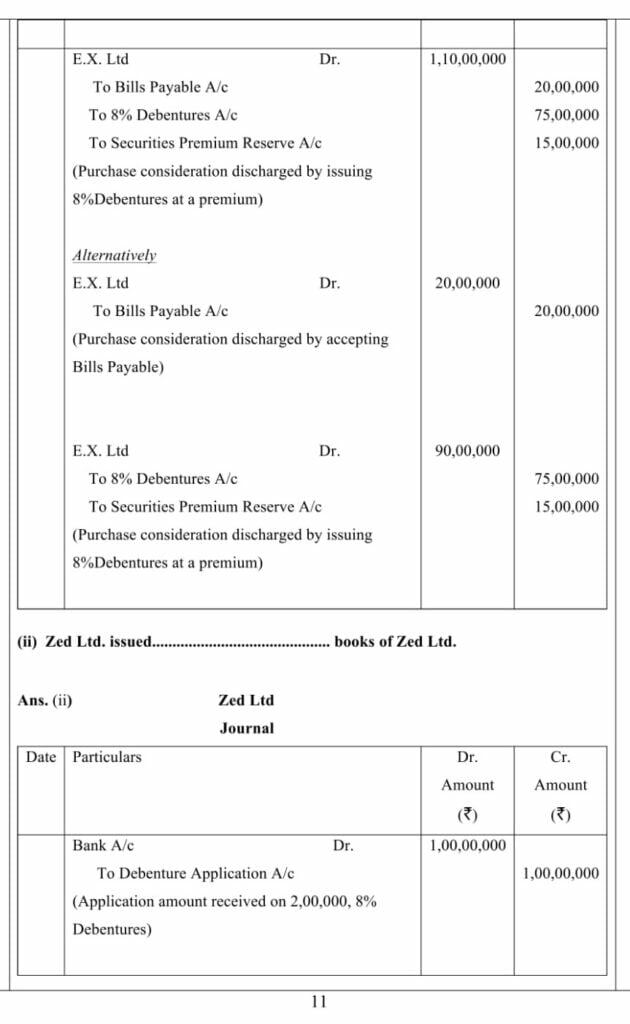

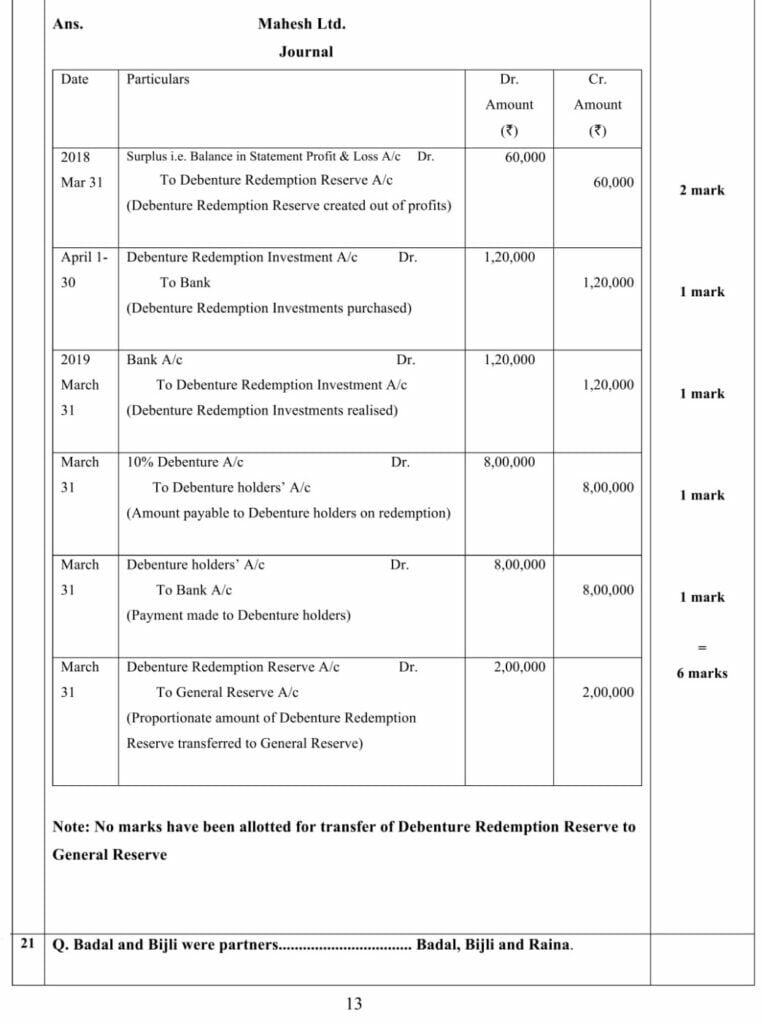

(Analysis of Financial Statements)

Ans.23- Limitations of Financial Statements are: (Any one)

(i) It is a Historical Analysis as it analyses what has happened till date. It doesn’t reflect the future.

(ii) It ignores price level changes as a change in price level makes analysis of financial statements of different accounting years invalid.

(iii) It ignores qualitative aspect as the quality of management, quality of staff etc. are ignored while carrying out the analysis of financial statements.

(iv) It suffers from the limitations of financial statements as the analysis is based on the information given in the financial statements.

(v) It is not free from bias of accountants such as method of inventory valuation,method of depreciation etc.

(vi) It may lead to window dressing i.e. showing a better financial position than what actually is by manipulating the books of accounts.

(vii) It may be misleading without the knowledge of the changes in accounting procedure

Ans.24– No change

Reason: It results in increase in asset (debtors) and decrease in other asset (bank)with the same amount.

Ans.25– False

Ans.26– ₹ 19,00,000

Ans.27- Any one of the following:

(i) Payment of dividend

(ii) Interest on Long term Borrowings

(iii) Issue of Shares for cash

(iv) Issue of Debenture for cash

Ans.29– (B) / Three months or less

Ans.30– Total Assets to Debt ratio = Total Assets /Debt.

Total Assets = Shareholders’ Funds +Total Debt

= ₹7,50,000 + ₹19,50,000

=27,00,000.

Debt = Total Debt – Current Liabilities

=19,50,000 – 4,50,000

=15,00,000

Total Assets to Debt ratio = ₹27,00,000/₹15,00,000

= 1.8: 1

Q.30- Under which major head……………….. Companies Act, 2013?

| Item | Major Head | Sub Head |

| Computer software | Non-Current Assets | Fixed Assets-Intangible Assets |

| Calls in advance | Current liabilities | Other Current Liabilities |

| Outstanding salary | Current liabilities | Other Current Liabilities |

| Securities premium reserve | Shareholders funds | Reserves and Surplus |

| Patents | Non-Current Assets | Fixed Assets-Intangible Assets |

| Interest accrued on investment | Current assets | Other current Assets |

Q.31- From the following information… Profit and Loss:

Answer.31– Comparative Statement of Profit & Loss for the years ending 31 March 2018 & 2019

| Particulars | 31 March 2018 ₹ | 31 March 2019 ₹ | Absolute Change ₹ | Percentage Change |

| Revenue from Operations | 4,00,000 | 3,00,000 ( | (1,00,000) | (25) |

| Add Other income | 80,000 | 40,000 | 40,000 | (50) |

| Total Revenue | 4,80,000 | 3,40,000 | (140,000) | (29.17) |

| Less Expenses | 2,00,000 | 150,000 | (50,000) | (25) |

| Profit before Tax | 2,80,000 | 1,90,000 | (90,000) | (32.14) |

| Less Tax | 1,12,000 | 76,000 | (36,000) | (32.14) |

| Profit after Tax | 1,68,000 | 1,14,000 | (54,000) | (32.14) |

OR

Q. Prepare a common size………………………. following information:

Answer – Common Size Balance Sheet of L .X .Ltd

| Particulars | 31 Mar 2018 | 31 Mar 2019 | Percentage of Balance Sheet Total 2018 | Percentage of Balance Sheet Total 2019 |

| Equity and Liabilities | ||||

| Shareholders Funds | 10,00,000 | 20,00,000 | 50 | 40 |

| Non Current liabilities | 5,00,000 | 20,00,000 | 25 | 40 |

| Current Liabilities | 5,00,000 | 10,00,000 | 25 | 20 |

| Total | 20,00,000 | 50,00,000 | 100 | 100 |

| II. Assets | ||||

| Non Current assets | 12,50,000 | 30,00,000 | 62.5 | 60 |

| Current assets | 7,50,000 | 20,00,000 | 37.5 | 40 |

| Total | 20,00,000 | 50,00,000 | 100 | 100 |

PART – B

OPTION 2

Computerized Accounting

Ans.23- (D) / Batch processing

Ans.24– The height of a person is a single value attribute whereas academic qualification can be multi value attribute.

Ans.25– (C) / Inventory Subsystem

Ans.26– (B) / Up arrow key

Ans.27– A summary query is used to extract the aggregate data items for a group of records rather than a detailed set of records.

Ans.28- (D) /All of above

Ans.29- (C)/Required and must be unique

Ans.30- DA = BPE X (Applicable rate of DA for the month)

Where BPE= BP X NOE DP/NODM

Where BP=Basic pay

NOED = Number of effective Days present

NODM = Number of Days in a month

Gross Salary = BPE + DA+HRA +TRA

Where HRA = House rent allowance

TRA = Transport allowance

OR

Ans.30- (i) Contra Voucher : Used for fund transfer between cash and Bank A/c only.

If cash is withdrawn form Bank for office or deposited in the bank from office this

voucher will be used.

(ii) Receipt Voucher All the inflow of money is recorded through receipt voucher. Such receipts may be towards any income such a receipts form debtors, Loans/ Advance taken or refund of loan/advance etc.

Ans.31– Limitations of Computerised Accounting system.

1) Faster obsolescence of technology necessitate investment in shorter period of time.

2) Data may be lost or corrupted due to power interruption.

3) Data are prone to hacking.

4) Un-programmed and un-specified reports cannot be generated.

OR

Ans.32– Data validation is a feature to define restrictions on type of data entered into a cell. It makes the data accurate and consistent.

Eg. In a formula box, enter a formula that calculate a logical value. If the formula calculates TRUE entry it will be valid otherwise False entry will be in valid etc. if a sum value comes to be greater than the set limit it will be

invalid.

OR

Ans.32– The error is a # REF! Error.

This error occurs when a cell reference is not valid to correct this error following steps should be followed.

(i) Click the cell which displays error and see if it display a show calculation steps.

(ii)Review the possible causes.

(1)Deleted cell referred in the formula.

(2)Change formula to restore cells or undo.

(3)Use OLE (object linking + embedding for program that is not running

(4)Start the program

(5)Linking to correct DDE

Running macro that enter a function that return # REF !

ये भी पढ़े …….